does venmo have transfer limits

What is Venmo?

Venmo is a peer-to-peer digital payment service that allows people to send and receive money instantly. It started as a payment system through text messages, capitalizing on the opportunity to use its platform as a social network where friends and family can connect.

In 2012, Braintree acquired the company for $26.2 million. Braintree and Venmo were later purchased by leading global online payments system provider PayPal Holdings Inc. PayPal Holdings PayPal Holdings, Inc. is one of the largest online payments companies that allow parties to make payments through online funds transfers. The online payment system offers electronic alternatives to traditional payment methods such as money order and checks. PayPal provides a platform for online vendors, auction sites, Venmo is now accepted as a payment system in over two million locations in the United States.

How Does Venmo Work?

New users can enroll on the Venmo platform using an email address Contact Us Contact us directly for anything we can help you with. We have phone, email, and chat support. We're here to help you advance your finance career. . Alternatively, users can also join the platform by connecting their Facebook account with the digital payment service, which allows them to use their login details on Facebook to log in to the digital payment platform. The Venmo app is also available for download on both iOS and Android devices, and it includes all the functionalities of the web platform.

Once a user is registered and logged in the system, the next step is to connect with family and friends who use Venmo. Networking with other people on the platform allows users to collect payments or send payments by linking their debit or credit card accounts. When sending money to a person on the network, a user is required to choose the person to whom they want to send a payment, indicate the amount to send, provide the reason for the payment, and confirm the payment.

The reason for the payment is displayed on the timeline that can be viewed by people on the network, but they can choose to make the reason private and hide it from their timeline. The recipient will get a receipt of payment, link a bank account, and deposit the money securely.

Venmo Fees

Venmo is a free-to-use payment platform that makes money through transaction fees. Most of the transactions conducted through the platform do not incur any transaction fees, which makes it popular among millennials. Some of the free ways to send money on the digital payment service include using the Venmo balance and using a debit card or a checking account connected to Venmo.

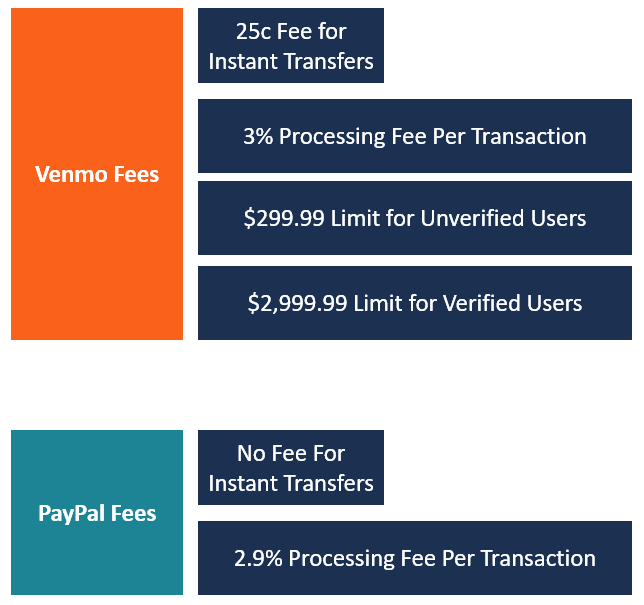

For major credit card transactions, the company charges a 3% processing fee for every payment made using a credit card. In comparison, Venmo's parent, PayPal, charges a 2.9% transaction fee for all debit and credit card transactions. Also, Venmo charges users a 25-cent fee for instant transfers of one's Venmo balance to their bank account.

Venmo Transaction Limits

Venmo limits the amount of money that customers can transact through the platform. For registered users without identity verification, the company imposes a $299.99 rolling limit on the total payments and purchases per week. It means that for every seven days, unverified users cannot transact more than $299.99. The limit starts once a user makes the first transaction, and continues until they use up the remaining limit within the seven-day period.

Once a user has verified their identity, the transaction limit is raised to $2,999.99 for the amount of money that can be sent to another user. The verification process requires users to provide the last four digits of their social security number, date of birth, and zip code. The limit increases by $2,000 per transaction for payments made to authorized merchants.

The company limits the number of payments to authorized merchants to 30 transactions per day. Also, it limits Visa Debit card transactions to $2,000 per transaction. The digital payment service does not limit the amount of money that customers can receive through their Venmo account.

Transferring Funds to Bank

When transferring a balance from the Venmo account to the bank, the company displays the estimated payment arrival date on the dashboard. Typically, the digital payments provider discloses that regular withdrawals to the bank account take an average of one business day, as long as the transaction is completed before 7:00 p.m. Eastern Time. It means that transactions made after 7:00 p.m. will take longer than one business day.

Transactions made during weekends and bank holidays also take longer, since the days don't count as business days. For example, if a transaction is made on a Friday, it will likely not be available in the account till Monday since Saturday and Sunday do not count as business days.

Is Venmo Safe?

Venmo states that it uses bank-level data encryption and security measures to protect its customers from unauthorized access to their accounts. Users are also required to create a PIN code that they use to access the platform via mobile applications. The company provides a guarantee of its customer's security, and if the security measures fail and customers report the issue within two business days, the customers will only be liable for $50 worth of losses.

Also, if you lose your smartphone or tablet with all the Venmo information saved on it, you should lock the device to prevent unauthorized access by the person who picks it up.

Related Readings

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful:

- Accounts Payable Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are

- Acquisition and Payment Cycle Acquisition and Payment Cycle The Acquisition and Payment Cycle (also referred to as the PPP Cycle for Purchases, Payables, and Payments) consists mainly of two classes of

- Credit Sales Credit Sales Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by

- Prepayment Prepayment A Prepayment is any payment that is made before its official due date. Prepayments may be made for goods and services or towards the settlement of debt. They can be categorized into two groups: Complete Prepayments and Partial Prepayments.

does venmo have transfer limits

Source: https://corporatefinanceinstitute.com/resources/careers/companies/venmo/

0 Response to "does venmo have transfer limits"

Post a Comment